GST 2.0: Simplified Rate Structure for a Stronger Economy

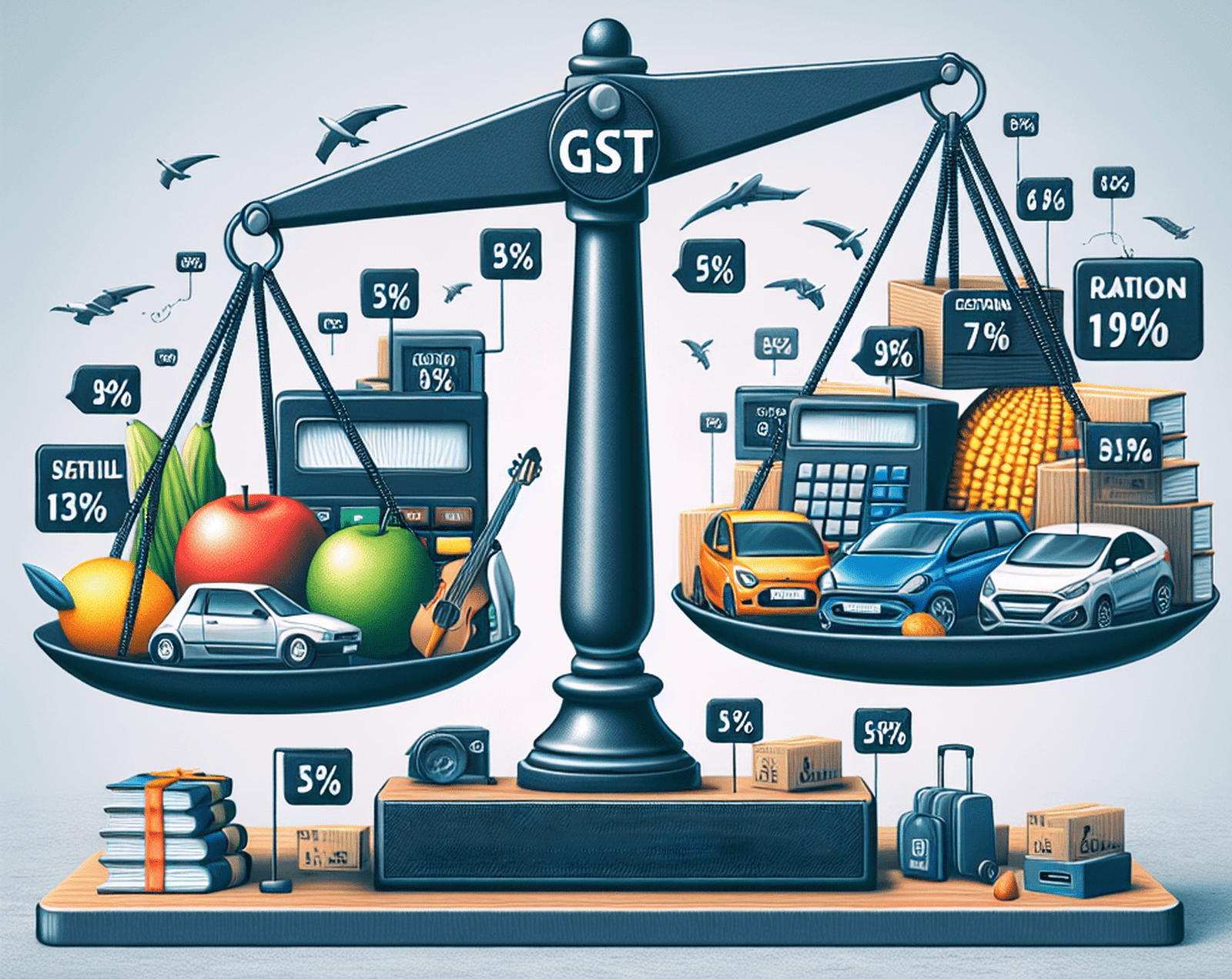

"The Goods and Services Tax (GST) in India is undergoing its biggest reform since its launch in 2017. The government has now introduced GST 2.0, a rate rationalisation move designed to simplify taxation, boost compliance, and make life easier for both businesses and consumers."

1. What Has Changed?

-

Two Main Slabs: Under GST 2.0, the number of tax slabs has been reduced. From multiple layers earlier (5%, 12%, 18%, and 28%), India will now follow just two primary rates — 5% and 18%.

-

12% & 28% Slabs Removed: These slabs have been abolished, and goods/services falling under them are now redistributed into the 5% and 18% categories.

-

Special Sin Tax: Items such as cigarettes, pan masala, and certain luxury goods will continue to attract a 40% “sin tax”, ensuring revenue stability while discouraging unhealthy consumption.

2. Why This Change?

-

Simplification: A two-slab system reduces confusion and compliance burdens.

-

Boost to Businesses: Easier pricing strategies, better clarity for MSMEs, and fewer disputes.

-

Consumer Relief: Everyday goods, essentials, and services may now become more affordable.

-

Growth in Demand: Lower rates in key sectors aim to stimulate spending, helping economic growth.

3. Impact Across Sectors

-

Winners: FMCG, agriculture products, consumer electronics, and essential services are expected to see price drops.

-

Challenged Sectors: Luxury goods, sin goods, and premium lifestyle items will face higher tax burdens.

4. What It Means for You

For the common consumer, GST 2.0 could mean lower household expenses. For businesses, it means easier compliance, better planning, and reduced disputes with tax authorities.

5. Conclusion

The launch of GST 2.0 with rate rationalisation is a historic step towards a simplified and business-friendly tax system in India. While its full impact will unfold over the coming months, one thing is clear: this reform is a big stride towards transparency, growth, and ease of doing business.